Your credit score is one of those invisible swords hanging over your head. You can use it to get you further along in life, or, it can loom ominously over you, casting dark clouds of doubt over your financial stability. When you learn how to “play the game” and improve your credit score, you can improve your chances of buying property, buying a car, and maintaining a reputation as an upstanding citizen. Here are five things that can damage your credit score:

- Skipping Payments

We all know that skipping payments can negatively impact a credit score. It can damage the credit you’re trying to build and set you behind in your financial goals. Not to mention the unexpected payments, like health care. One way to avert this hassle and mess and settle the account quickly when you’re down and out is by looking at alternatives to payday loans. They’re generally very fast at paying out and the interest is minimal.

- Failing To Cancel Memberships

A membership, like to the gym for example, that runs on automatic debits from your account makes the entire process far simpler for the gym. You don’t have to keep submitting payments manually each month and the gym doesn’t have to bill you and invoice you. Many consumers are unaware that most contracts, while they run for a fixed term, also have an autorenewal system in place. That means your contract will continue beyond its stated terms unless you specify otherwise. There is usually a procedure in place to cancel memberships. If you were unaware of this, the debits that extend beyond the contract may bounce, resulting in a negative credit score.

- Utility Bills

In the same way that gym payments may go unpaid because you didn’t realize the account was still active, utility bills can also impact your credit score negatively. Make sure you follow the proper procedure and that you have written confirmation that an account has been closed. Avoid defaulting on utility bills and do your best to prevent late payments. If you’re moving, it’s often best to go and visit companies where you’ve had accounts to ensure you’re fully up to date on your payments. If they fail to reach you with an outstanding amount, even if it is a small sum, they can hand you over, which will result in a negative credit score.

- Ignoring Minor Fines

Library fines, for example, are often for small amounts. You may consider it pocket change and the reason it goes unpaid is simply that you didn’t carry such small change with you. Remembering to go back for a small fine is often forgotten. The result is that the library runs at a deficit with many library members sitting on unpaid fines. Many libraries have started handing their outstanding fines over to debt collection agencies. If your local library does this, you could damage your credit score when you leave your fines unpaid.

- Ignoring Traffic Tickets

Traffic violations can be infuriating but they are best tended to and not ignored. The city and state departments are usually involved in this. The longer you default on your payments, the more likely that your outstanding fines might be handed over to the credit bureau. This will negatively impact your credit score, especially if you are handed over to debt collection agencies.

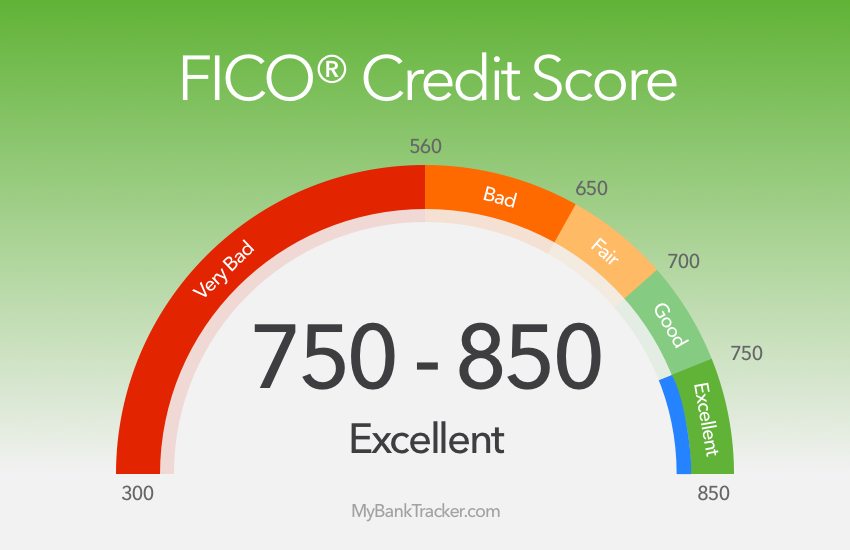

Unsure what your credit score is? Find out soon and work to improve it. A perfect score is rare, but getting into the green is easy. Short-term loans can help to settle any outstanding debts, enabling you to pay them off in bite-sized monthly chunks.