Depending on where you live the proposed tax plans may put a significant dent in your wallet

The GOP’s touts their tax proposal as a “boon” for the middle class. But when you read the fine print it makes a difference if you itemize your tax as well as where in the country you live.

The House of Representatives passed the Tax Cuts and Jobs Act. Under the bill, it would reduce tax brackets from seven to four, and increase the standard deductions allowed. Senate Republicans rolled out their plan last week which differs slightly from the house plan.

As usual, depending on where you fall on the earnings spectrum exactly how much you will save will depend on many different factors. It looks like the cuts might not be as profound as President Trump touts.

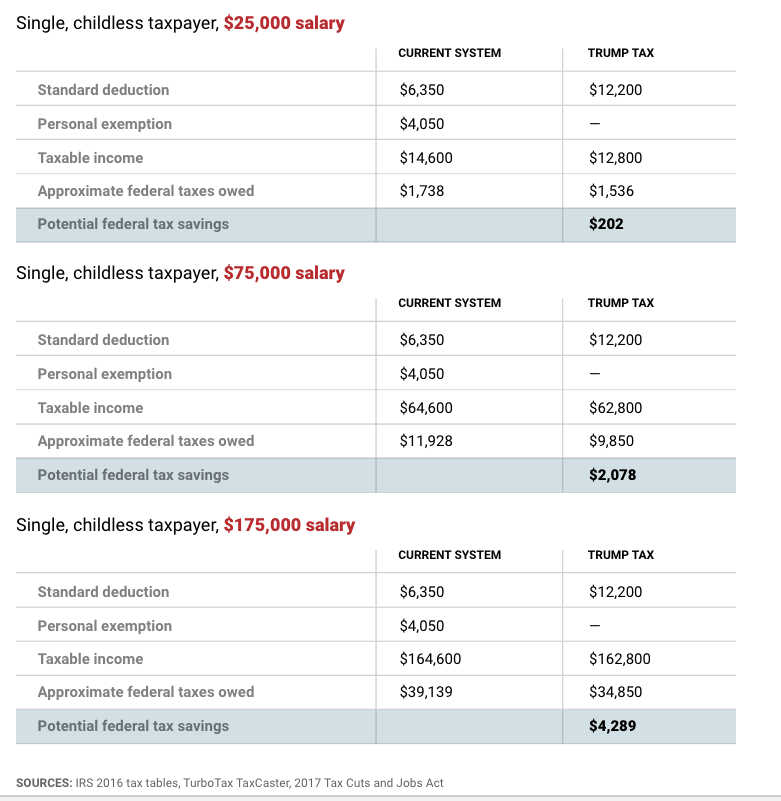

Here are Three examples of the new plan at $25,000, $75,000 and $175,000:

Source: BusinessInsider.com

According to the table Americans earning $25,000 will only $202 per annum. People earning $75,000 will see approximately a 3% raise and those who earn $17,5000 save roughly 2.5% yearly. This does not appear to be a robust tax cut for the middle class by any stretch of the imagination. Also at issue is the ability to write off property taxes on your Federal Tax returns. Being from NJ, I’ve paid over $20,000 per year in local property taxes alone. My favorite is when I owned a townhouse and paid $13,000 per year without owning 1 blade of grass!

The elimination of this important deduction will proportionally affect blue states such as New York, New Jersey, California and Connecticut. Is this the GOPs cloak and dagger revenge to stick it to the Dems? We asked Dr. Bart Rossi, who is a renowned Political Analyst, to come on our podcast to discuss what the new proposed tax plans really means for you.

Take a listen:

What do you think of the new GOP / Trump tax plan? Leave your comments below or email me directly: [email protected]