So, how do you like 2020 so far? To think we’re not even two-thirds of the way and already so much has happened – most of it, of course, is connected to the global pandemic. The COVID-19 has affected most aspects of our lives and placed many industries and economies under tremendous pressure. It had an impact on just about every instrument group imaginable, and currencies, of course, were no different. In today’s article, we will look into a couple of major currency pairs, how they’ve been affected by the coronavirus crisis and what it could mean for CFD traders.

EUR/USD

In early 2020, USD bulls should have been pleased, as the US Dollar enjoyed its best start to a year since 2015. The uncertainty surrounding the coronavirus supported the demand for safe-haven instruments. The greenback is viewed as having certain safe haven qualities.1 This means its price tends to rise during market crises – note we used the word “tend” since this doesn’t always take place.

But the pandemic wasn’t the only thing boosting the North American currency. Positive economic data from the United States also supported the price rise, as well as other factors.

So, we can guess why the USD was strengthening, but why was the Euro weakening? Pressured by not-so-great economic data, the Euro decreased against the Dollar. In February 2020, the EUR/USD fell to its lowest level in 3 years.

Then, in March 2020, the Federal Reserves and American government moved into action. In an attempt to aid the struggling economy and battle growing unemployment and battle the possibility of a major recession, they introduced massive stimulus packages, and many central banks and governments around the globe did the same. The possibility of inflation affected the greenback’s appeal, leading to a major USD sell off2 and a EUR/USD increase.

Then, in March 2020, the Federal Reserves and American government moved into action. In an attempt to aid the struggling economy and battle growing unemployment and battle the possibility of a major recession, they introduced massive stimulus packages, and many central banks and governments around the globe did the same. The possibility of inflation affected the greenback’s appeal, leading to a major USD sell off2 and a EUR/USD increase.

What happened next is simply related to supply and demand. Pressured by the escalating COVID-19 crisis, large Institutions and companies needed US Dollars for funding, resulting in a temporary shortage and, obviously, a price increase.3 During less than 2 weeks in March, the EUR/USD pair decreased by over 6%.

In May though, the Euro began to strengthen against the USD, rising by as much as 9% between May 6th and August 6th. This took place as the pandemic was slowly easing in Europe with many economies re-opening. At the same time, the number of cases in the United States was rising daily and the country was also facing social unrest and nearing Presidential election.

The USD/JPY

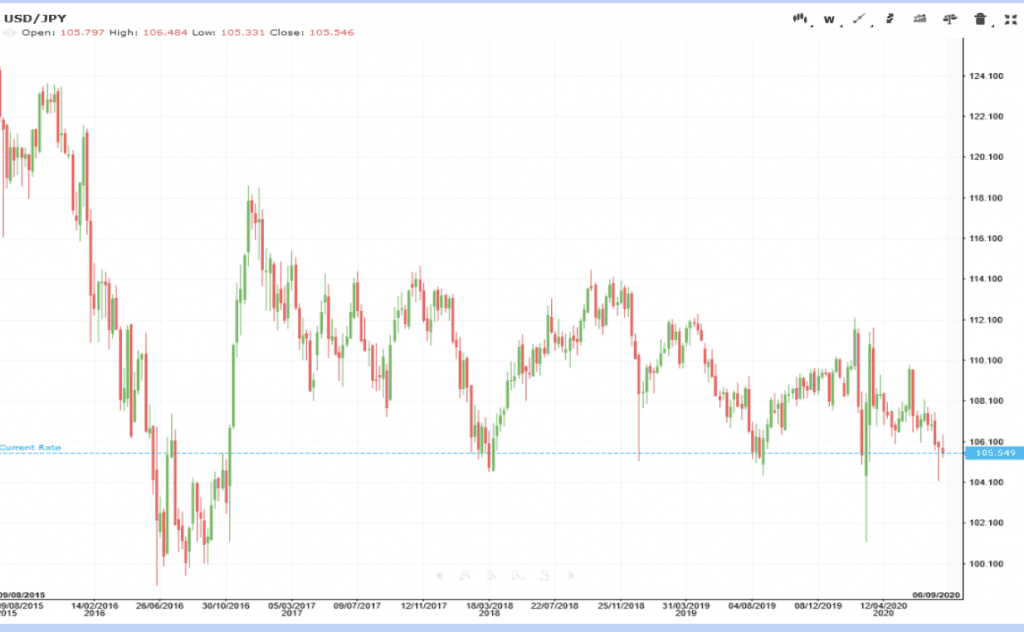

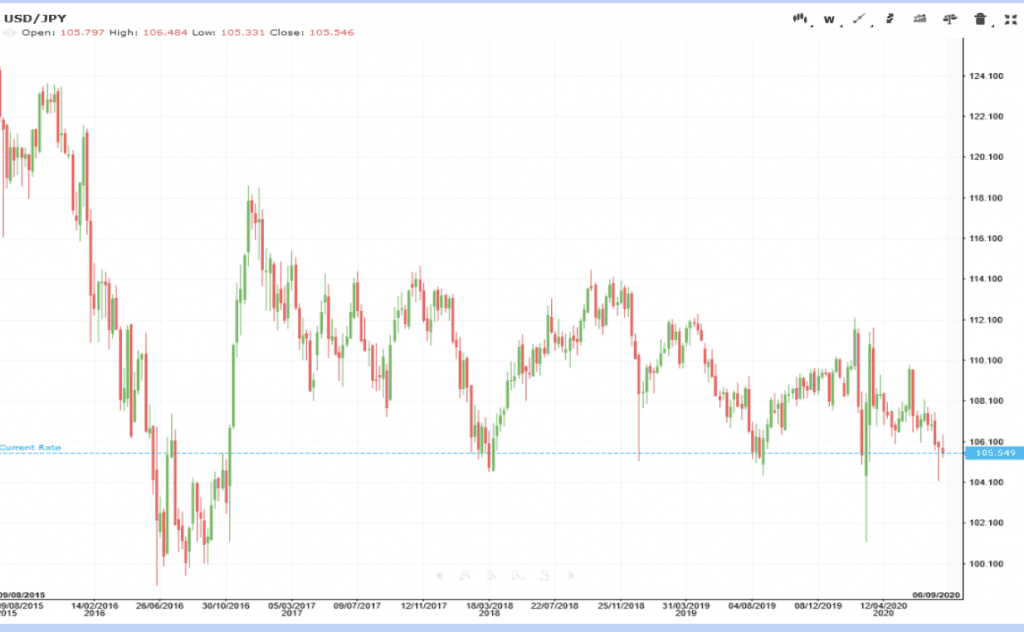

Just like the US Dollar, the Japanese yen is also viewed as having certain safe haven qualities, but in the early weeks of 2020, it appeared as if the Yen’s appeal was not as great as that of the greenback. It’s possible that in January when it appeared as if the coronavirus was mostly affecting Asia, the Japanese economy appeared to be more at risk than North America. As February neared its end though and it was becoming clear that infection was spreading to the rest of the world, the US Dollar sell-off took its toll on the USD/JPY. Between February 21st and March 9th, the pair’s price crashed by more than 9%. Other factors that may have affected the price include the decreasing oil prices and the global stock market crash, which may have had a positive effect on the yen.4 Then, the growing demand for Dollars changed the trend, and between March 9th and March 25 the greenback recovered against its Japanese peer.