Your credit score can be one of the most important signifiers of your life to large institutions. The course of your life could literally be made or broken based on a credit institution agreeing to take a chance on you.

You need a solid credit score to buy a house, a car, or start a business. You’ll need a strong credit score if you need to borrow money to get by when times or tough. Without a strong score, life can get to be very difficult.

If your score at this point in time is less than stellar, it’s essential that you learn how to restore credit scores. Getting your credit back up to a high level will be important if you hope to retain a high quality of life. Read on and we’ll walk you through what you need to know.

- Understand the Basics

One shocking thing about Americans is that many don’t know what their credit score is or how it works. This means that they are putting themselves in a terrible position. They will not be in control of their financial futures.

What is a credit score and where does it come from? It comes from the instances where an individual has borrowed and returned money. This could be something as simple as using their credit card or as involved as paying back a mortgage on a house.

If a person repeatedly borrows and returns money on time, their credit score will rise. If they borrow money and fail to pay it back by certain deadlines, their credit score will fall.

A person who has never borrowed money from a lender will also have a low credit score. This is because lenders simply won’t have a sense of how responsible or not a person really is when it comes to borrowing funds.

If you’ve never borrowed money before, it’s important to open a credit card and start building your credit score. This way you can have a strong score when the time comes that you really need it.

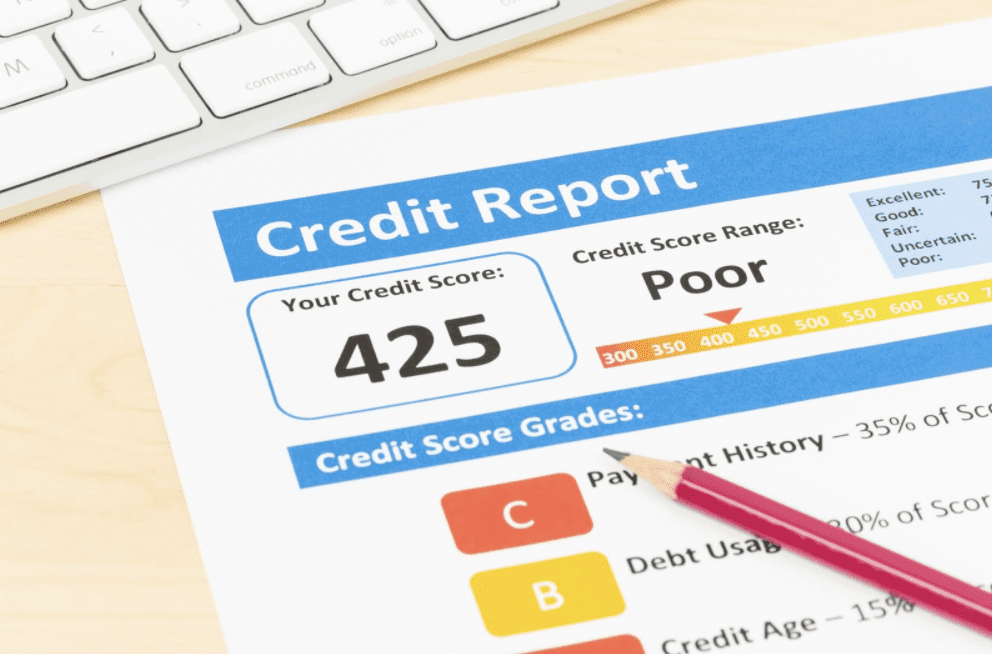

A credit score is a numerical expression that ranges from 300 to 850. The higher a score the better, and any score over 700 is generally considered to be good. There are a few different companies out there that track and report credit scores.

You can use any of these providers to check your own personal credit score. Sometimes it’s good to check from multiple providers, as you never know which provider a money lender might look at it.

- Dispute False Charges

Once you get your credit score, you should be able to see how your standing currently is. You’ll also be able to see the events and instances that drove your score down. While credit score providers are generally good at their work, it is possible that there are instances where incorrect information has been reported.

If this is the case, you need to work fast to dispute these errors and recover your proper credit score. Often collection accounts from healthcare providers will appear on your credit score report. It’s common for an insurance company and healthcare provider to have a miscommunication on payment and for your credit score to take a hit. Sometimes this happens without you even knowing!

Digging into your credit score will allow you to see what’s gone wrong and to resolve any false issues if you catch them.

- Pay Your Outstanding Balances

Do you still owe money to certain lenders right now? Haven’t paid off your credit card? It’s these outstanding debts that can continue to drive your credit score down. Resolving these issues as soon as possible will be one of the most necessary steps you make to resolving your credit issues.

If you have the money to pay off these debts, you should get it over with as soon as possible. However, not everyone has the money they need in hand to pay off all the debts that they currently face.

In this situation, it’s important that you read about debt consolidation and consider the options you have available to you. There are many ways to manage your debt and make it into something more easily dealt with.

Paying off these balances shouldn’t just be a short-term solution to your problems. It should be an on-going financial philosophy that you adhere to for the rest of your life, to the best of your ability. Resolve to pay your bills on time going forward.

- Open a New Credit Card Account

Your credit score is somewhat built off of your credit card utilization ratio. If you open a new credit card account and don’t (or hardly) use it, you’ll actually be driving your credit score up.

If this is your plan, it’s best to head to your own bank branch and get a card without an annual fee. While opening a new credit card account can be helpful, you want to be careful as well. You could be tempted to run up a new balance on the card which could only make your situation worse.

Opening multiple credit card accounts can also mark you as suspicious to credit check providers. Open one new account and leave it at that if you can help it.

How to Restore Credit If Your Score Is Down

You need a strong credit score to move through the world easily. If your credit score is down at the present moment, it’s important that you take the time to learn how to restore credit. The above information can be of great help.

Need more financial advice or tips? Keep scrolling our blog for more.