Robots Are Taking Over! Now They Are Managing Our Money!

2016 was pretty decent year if you invested in the DOW Jones Industrial Average which saw an increase of roughly 13%, while the S&P Index came in just south of 10% for the calendar year. With that said, it should have been a banner year for professional traders, especially Hedge Fund Managers, right? Well, 2016 was a year most hedge funds would be happy to forget. And while the same goes for 2015, 2014, 2013, 2012, 2011, and 2010, according to tell like it site Zero Hedge.

Since the financial crises, most hedge funds have failed to produce a competitive return vs. major benchmark indices, especially when you account for their relative risk.

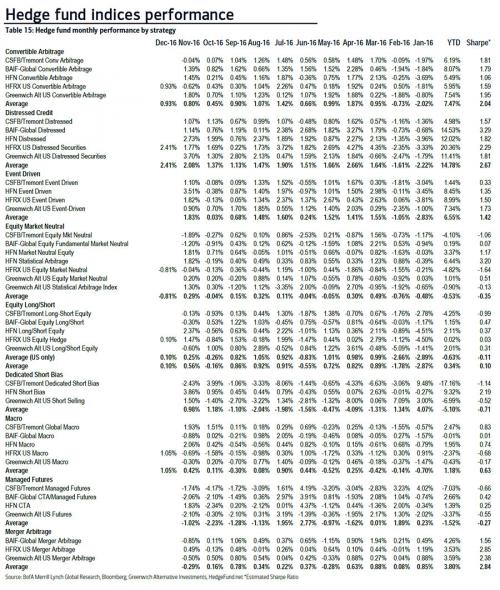

In 2016 – a year many said would mark a renaissance for active managers – the “flash hedge fund return” according to a report by BofA’s Paul Ciana , was a measly 3.34%, which as BofA conveniently calculated meant they “underperforming the S&P500 index by 6.2%” at which point your average underperforming Hedge Fund Manager complains that they shouldn’t be benchmarked against the S&P, even as the redemption notices flood in and the AUM gets ever smaller, reports Zero Hedge.

As you can see the major players in the Hedge Fund field underperformed, unless you were involved with distressed credit or market driven events. So will 2017 will continue the same underperforming trend? Perhaps there is light at the end of the tunnel. According to a recent article in hedgeweek.com “In the face of more than USD100 billion in investor redemptions in 2016, hedge funds continue to perform surprisingly well out of the gate in 2017, according to eVestment’s January 2017 Hedge Fund Performance Report”.

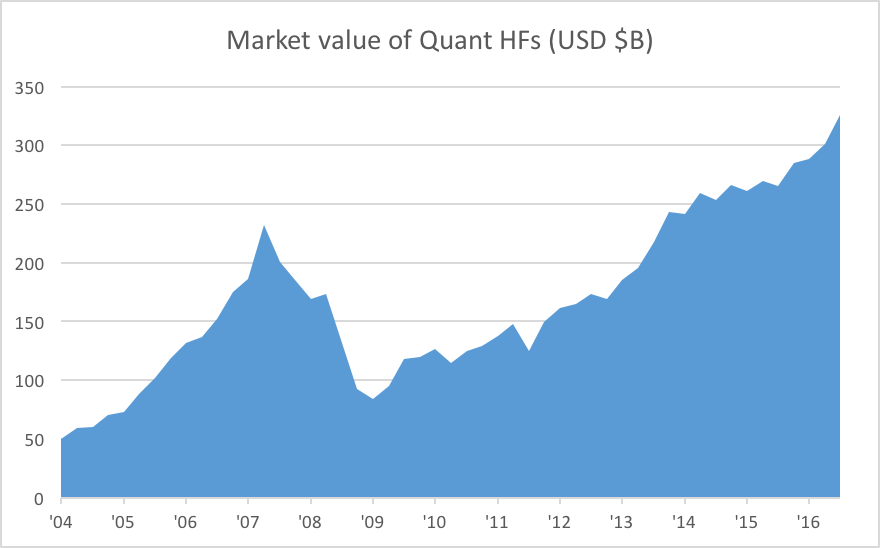

There seems to be some type of turnaround as the hedge funds are showing a rebound so they can begin to stop the bleeding (redemptions) and get back on track. Well yes and no. Yes, money will be pouring back into hedge funds (or at least temper redemptions). But also “no”, as the money will not flow into traditional hedge funds with big names on the wall. Hence the rise of the Quants! Cars will be driving themselves soon, why not put your money on autopilot?

Recently machines once again demonstrated their superiority as Google’s DeepMind AI battered the reigning (human) world champion at Go, making it the latest classical board game to fall to machine dominance., according to a recent article by Novus Partners. As the first self-driving cars hit the streets and Wall Street adapts to robo-advisors, a comparable divide grows among hedge funds. Quantitative strategies, also known as “Black Box” for the mystery surrounding their algorithms, have been growing in absolute and relative terms. They’ve also recently been outperforming human counterparts, attracting even more investor dollars. Market values controlled by machine-based algorithmic hedge fund strategies (quants) have more than tripled since 2009, cites the Novus report:

Source: https://www.novus.com/blog/rise-quant-hedge-funds/

Will hotshot analysts be fully replaced by computers backed by Artificial Intelligence algorithms? Large companies like IBM and Google’s parent Alphabet are betting big on AI to transport us, make medical decisions and educate our youth. So its no surprise that the same technology might undo one of the most important industries, the good old fashioned hedge fund sector. People invest in hedge funds for two reasons: results and reputation. Although reputation is extremely important, Fund Managers will overlook their IVY league classmate in favor of performance all day long. That is why many traditional funds will need to at least adopt a hybrid approach to this type of investing.

Do Millennia’s Matter in This Equation?

As the talent pool gets tighter as it will now be an absolute necessity for Hedge Funds perform, the new talent pool is naturally comprised of Generation Y. Further, Fund Managers are beginning to see their seats filled with Millennials as they view performance differently and will most likely rely strictly on performance and not care as much about heritage or reputation of a hedge fund. They are more technology driven then previous generations having check their smart phones over 150 times a day, vs. 40 for older generations. Between their impatience and unyielding acceptance of technology, this will be an absolute wake-up call for the Hedge Fund industry. In less than 10 years, Generation Y will compromise of 80% of the workforce. Further as they grow, so will their assets as they will become the investors themselves. So it is a do or die scenario of our hedge fund friends. Performance will always need to be there, but the big question, how will they get job done?