You have probably heard time and again from financial experts and investment advisors on the importance of having a high credit score and the repercussions of a low score on your ability to obtain credit.

But that’s not all; a poor score can impact your day to day life, and influence major aspects of your life, including relationships.

Sounds far-fetched?

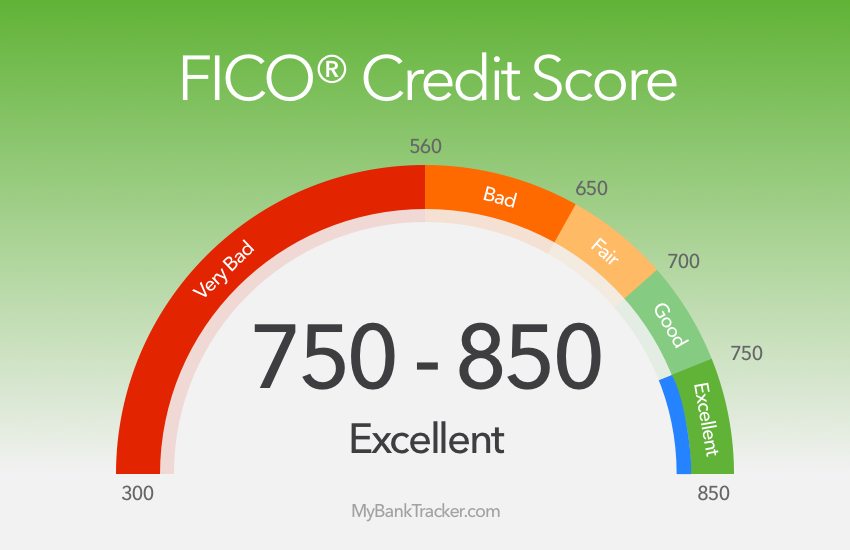

To understand this connection, let’s define a credit score; it is a numerical representation of the creditworthiness of an individual based on an analysis of the person’s credit report which is sourced from credit bureaus.

An individual’s credit report contains data on their credit activity submitted to the credit bureau from financial companies, lenders, and credit card companies.

Here are various factors contained in the credit report that subsequently affect a credit score.

- Payment history

A missed or late payment records on your credit report and resultant issues such as charge-offs, liens, bankruptcies, foreclosure, and civil suits have a major negative effect on your score.

- Credit utilization rate

This is a look at the outstanding debt you have compared to your total credit limit in all revolving accounts. It shows how much of the available credit you are using. The lower this rate is, the better.

- Length of credit history

Credit reports show the opening dates of each account and its closure, the average age of all accounts, the age of the oldest account as well as the newest. A long credit history indicates experience in handling debt.

- Diverse credit accounts

It shows the ability to handle different types of credit. Having both revolving accounts and installment loans gives you a better score.

- Hard inquiries

For every credit-based application, an inquiry is made on your credit report. Too many of these inquiries in a short period hurt your credit score.

Based on these factors, your score may stand between 300 and 850. A low number indicates you are not trustworthy with credit while a higher score shows better control of your spending and debt.

The following are ways in which your credit score affects your quality of life.

Credit Card and Loan Approval

Everyone is after making progress in life, and this involves buying assets or making investments. It requires financing from lenders such as banks. Your chances of getting a loan approved while your credit history is poor are slim, and if accepted the loan is likely to be low and the interest high though some online lender finding services like nation21loans.com are exceptions and can get you approved from a good lender even with bad credit. A good credit report, on the other hand, qualifies you for a variety of facilities.

Credit cards can come in handy during emergencies or when there is a salary delay. With poor credit history, the chances of getting your credit card application approved or having your limit increased are low.

It Determines Where You Live

Whether you want to rent or take a mortgage, a bad credit history affects your choice. Before banks and mortgage lenders approve a mortgage, they have to check the creditworthiness of the customer thoroughly. It then influences their decision on the credit limit they offer and at what interest rate. With a low score, the offer may not meet the type of home you desire.

According to a survey report by Rent.com, property owners consider the credit profile/score of a prospective tenant the second most crucial factor to asses after their current income-to-rent ratio. With a bad credit score, your choice of the kind of house to rent depends on who is willing to overlook your bad credit history and not how good an apartment is.

It Can Disqualify You from Certain Job Positions

The Society for Human Resources Management reported that 47% of employers carry out a credit check on job applicants. Employers do not have access to your credit score. But according to the consumer’s rights as provided by the Fair Credit Reporting Act, they can check your credit report but with your written permission.

Your credit report can provide insight into your trustworthiness and sense of financial responsibility. It reduces the risk of internal fraud and theft in the company which can be motivated by high levels of debt. Your poor credit report could thus be the reason you never hear back from potential employers after an interview.

It Affects Your Expenses

When you have a weak credit report, it’s not just banks that are cautious when dealing with you but businesses such as utility companies and insurance providers as well.

These businesses may check your credit history to decide on the terms of engagement. If your credit history raises questions on your ability to pay bills on time, they are likely to ask for a deposit as security or charge a higher rate which causes increased expenses.

Better Relationships

Results from a survey by Bankrate indicated that 38% of the respondents felt that knowing a person’s credit score would affect their willingness to date them. Moreover, financial problems is a top reason for divorce according to family law specialists, Slater and Gordon. The state of your credit history can thus influence who you marry and how stable the relationship is.

The mental stress and financial strain that comes with a poor credit history can be a deal breaker for most people. It causes stagnation due to the lack of easy access to credit, and your partner’s finances may be indirectly affected by the higher expenses a bad credit report causes.

How to Improve your Credit Score

You can make improvements by applying the following tips.

- Pay bills on time

Payment of your bills is not enough, do it on time. Create reminders for when each bill is due and have a budget that ensures money is allocated for each.

- Pay off your credit card debt and keep your utilization low

Try to ensure that you keep your credit utilization rate at roughly 10%. Avoid closing unused credit cards; they reduce your utilization rate.

- Avoid too many applications within a short time

Space your credit applications. Ensure you are well qualified before applying to avoid inquiries that lower your score and yet are unsuccessful.

- Monitor your credit

Requesting a report yourself does not lower your credit score. It can help you detect errors early enough or spot cases of identity theft. You can also monitor your progress and make changes where needed.

Parting Shot

For financial health and peace of mind, a good credit score is necessary. It gives you negotiating power to acquire insurance, loans and credit under better terms, makes it easy to own assets and achieve growth, makes your relationships more stable, and gives you freedom of choice in owning a home and renting.

If your credit report is keeping you from living comfortably, start making improvements today. The change may not reflect immediately but it eventually will; be patient. Begin by requesting your credit report. Monitor your weakest points and draw a plan that can help you make improvements.

Create the habits of making timely bill payments, using less of your credit card, and avoid making too many credit applications.

If you have trouble getting back on track, seek help from a legitimate credit counsellor. It’s never too late to take control of your finances.